For this week’s blog, we thank Resource Works for the following article, and approval to reproduce it:

While producers talk much of natural gas and LNG being used to replace coal to generate electricity, there’s also an important fact to underline: Natural gas is the lifeblood of manufacturing here at home in Canada.

Indeed, the National Bank of Canada makes these points:

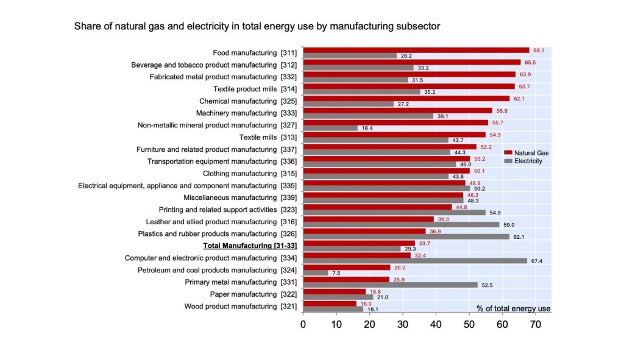

- Electricity is the second-largest energy source for Canada’s factories.

- As in other countries, manufacturing in Canada is highly energy-intensive, drawing nearly 34% of its energy from natural gas and 29% from electricity.

- Canada benefits from some of the most affordable natural gas in the world—prices are 77% below the G7 average and 50% lower than in the U.S.—thanks to the world’s second-largest resource base after Russia.

- While Quebec and Ontario have pledged to expand electricity capacity, these efforts will take years to materialize—just as Canada’s existing electricity surpluses are rapidly diminishing. Natural gas will be essential to bridging this gap, both as a fuel for power generation and as a critical input for a manufacturing sector in need of revitalization.

- Natural gas currently supplies approximately 70-75% of Alberta’s power, 45-50% in Saskatchewan and 16% in Ontario.

- Ontario says a rushed phase-out of natural gas could drive household electricity bills up by as much as 60% and risk widespread service disruptions.

And the bank notes how Canada’s supply of electricity (and that in the US) is under pressure because of surging electricity demand from a nascent industry: AI and data centres. “In the U.S., the largest power grid is already under strain as this sector consumes electricity faster than new generation capacity can be brought online. Electricity bills are projected to surge by more than 20% in the coming months.”

And while the U.S. demands more natural gas to generate more power, that can threaten those who import gas from the US: While Ontario and Quebec use gas to get power, more than half of the demand is still met through imports from the United States. “This reliance not only raises energy security concerns but also undermines Canada’s broader industrial strategy. At a time when AI, data centres, and manufacturing reshoring are driving up electricity demand, securing a stable, domestic natural gas supply is critical to ensuring cost competitiveness and long-term industrial resilience.”

Resource Works has long made the point that Canada faces a crunch in electrical supply, saying: “The electricity grid’s capacity will have to double in the next 21 years to meet the forecasted demand.” The National Bank adds: “With more than half of Eastern Canada’s natural gas now imported from the United States, securing domestic supply has become both an economic necessity and a strategic priority.” The bank goes on to show that electricity is also markedly cleaner in Canada than in most other countries:

“Canadian power generation emits about 50% less CO₂ per kilowatt-hour than the OECD average, and is over three times cleaner than in the U.S. and Germany, four times cleaner than in China, and five times cleaner than in India.” And this has helped Canada’s industrial sector to be relatively clean by global standards.

“In 2022, Canada’s manufacturing sector accounted for roughly 6% of the country’s total greenhouse gas (GHG) emissions, despite representing about 9% of GDP. By contrast, the U.S.manufacturing sector generated 12% of national emissions, exceeding its 10% GDP share.

“One key factor behind Canada’s lower emissions intensity is its cleaner and more cost-effective energy supply. For perspective, Canadian natural gas production has grown by 23% since 2010, while absolute emissions—not just emissions intensity—have declined by 28% over the same period.” And as manufacturing needs more natural gas, the bank goes on to say: “Fortunately, the potential expansion of TC Energy’s Canadian Mainline could add the incremental capacity needed to fully meet the natural gas needs of Ontario and Quebec. “With the Mainline Settlement up for renewal in 2027, TC Energy is currently assessing market interest and technical feasibility for several eastbound expansion options.”

“This initiative warrants strong policy support, as it aligns with Canada’s broader industrial strategy—reducing reliance on U.S. imports and the associated potential volatility in sourcing and prices, enhancing energy security, and enabling low-cost, domestic natural gas to power reindustrialization in Central Canada.”

And, speaking of policy, the National Bank calls on the Mark Carney government for a policy that formally recognizes natural gas as a transition fuel. Recognizing natural gas as a transition fuel would bolster energy security and lay the foundation for a more resilient, investable industrial base. “This need not signal a retreat from Canada’s climate commitments; on the contrary, it would provide a realistic and financially sustainable pathway for decarbonization and unlock capital investment.”

- This article as it appeared on Resource Works: https://ow.ly/Lkpf50WG1AK

(Posted here 20 August 2025)